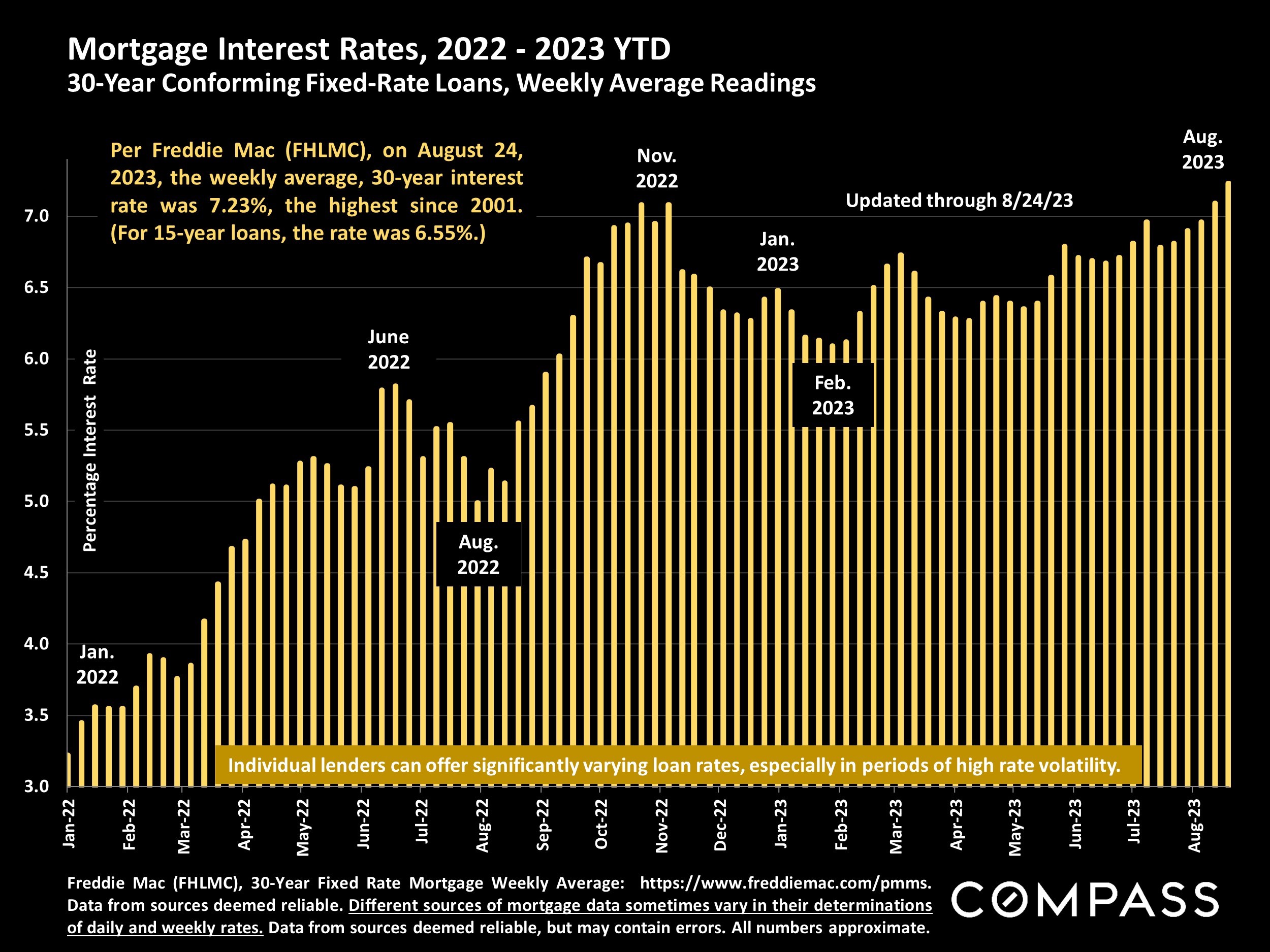

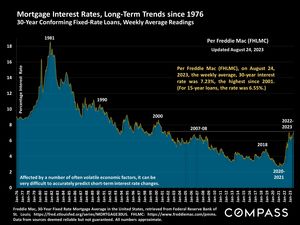

“Two factors are driving current sales activity – inventory availability and mortgage rates,” said National Association of Realtors® Chief Economist Lawrence Yun…”Most homeowners continue to enjoy large wealth gains from recent years [of appreciation] with little concern abo

National market activity generally slowed in July, a common seasonal trend after the spring selling season: July 2023 sales volume and median home sales price both declined from June.

(June often sees the year’s peak in both statistics.) However, July’s median sales price was up from July 2022, reversing a recent trend of year-over-year declines. Note that regions with large second-home markets often see very active summer markets. The autumn selling season begins after Labor Day, lasting through late October or early November, before the market subsides for the big, mid-winter holiday slowdown. Of course, sales occur in every month of the year.

Nationally, over a million fewer homes came on market in the 12 months through July than in the previous year. Along with the recovery in buyer demand since late 2022, and the continuing impact of interest rates on affordability, this has been a defining factor in market conditions. In particular, low inventory has played a substantial role in the 2023 rebound in home prices.

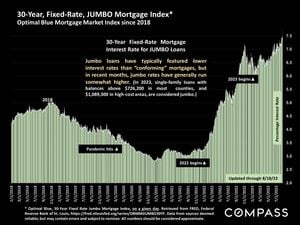

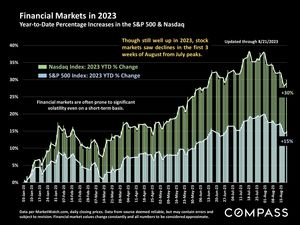

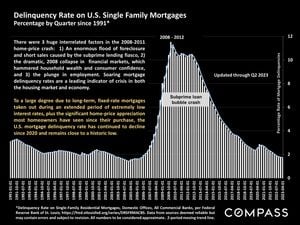

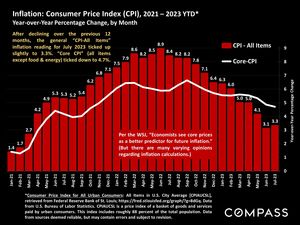

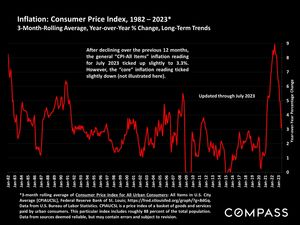

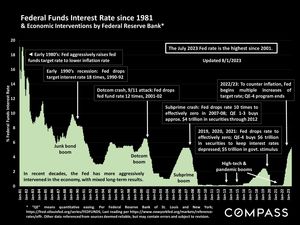

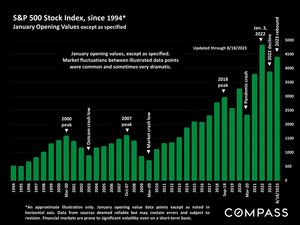

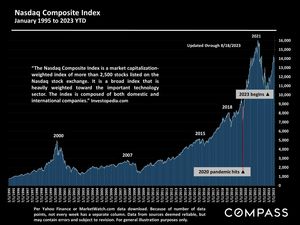

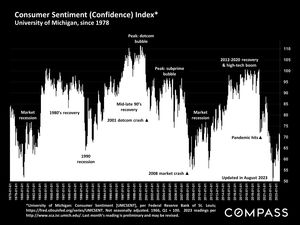

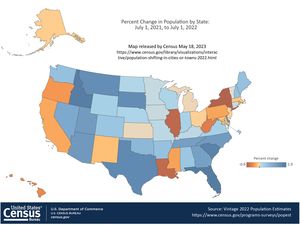

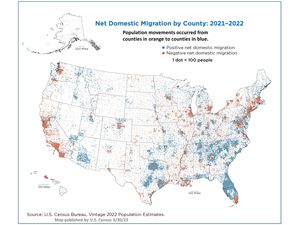

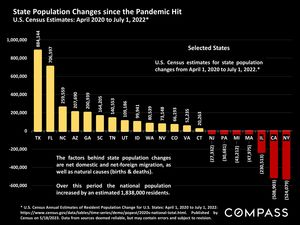

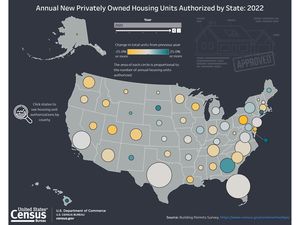

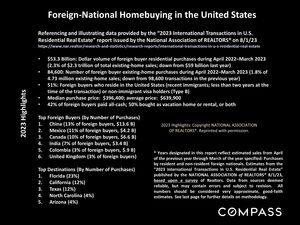

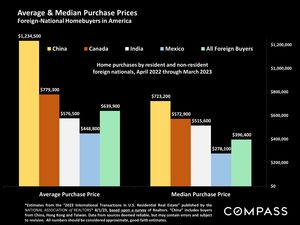

This report will review national trends in home prices, listing inventory, sales volume, offers received, days on market, all-cash purchases, and foreign homebuyers. It will also cover selected economic indicators, such as interest rates, inflation, stock markets and mortgage delinquency rates, and some demographic snapshots, including recent statistics on population migration.

A national report is a huge generalization of broad trends across an enormous range of regional submarkets, whose values and market dynamics vary. National data on August sales should become available in the third week of September.

ut home price declines.”